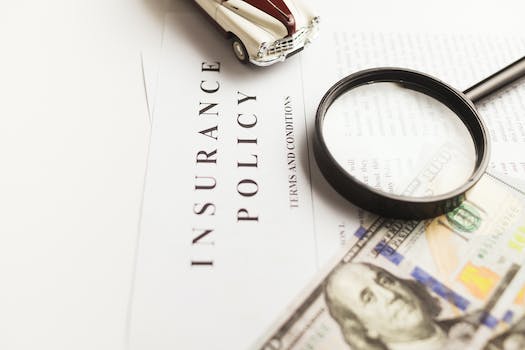

How to Choose the Right Car Insurance Policy for You

-

Table of Contents

Introduction

Choosing the right car insurance policy can be a daunting task. With so many different types of policies available, it can be difficult to know which one is best for you. It is important to understand the different types of coverage available and the factors that can affect your premium. This guide will provide you with the information you need to make an informed decision when selecting a car insurance policy. We will discuss the different types of coverage, the factors that can affect your premium, and tips for finding the best policy for your needs.

Understanding the Different Types of Car Insurance Coverage

When it comes to car insurance, it’s important to understand the different types of coverage available. Knowing what’s covered and what’s not can help you make an informed decision when selecting a policy. Here’s a breakdown of the different types of car insurance coverage.

Liability Coverage

Liability coverage is the most basic type of car insurance. It covers the costs associated with damage or injury you cause to another person or property. This includes medical bills, legal fees, and repair costs. Liability coverage is required in most states, and the minimum amount of coverage varies by state.

Collision Coverage

Collision coverage pays for damage to your car caused by an accident. This includes damage from hitting another car, a tree, or a guardrail. It also covers damage from a single-car accident, such as flipping your car or running into a ditch. Collision coverage is optional, but it’s a good idea to have it if you have a newer car or a loan on your car.

Comprehensive Coverage

Comprehensive coverage pays for damage to your car caused by something other than an accident. This includes damage from theft, vandalism, fire, hail, and flooding. It also covers damage from hitting an animal. Comprehensive coverage is optional, but it’s a good idea to have it if you have a newer car or a loan on your car.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage pays for damage to your car caused by an uninsured or underinsured driver. This coverage is optional, but it’s a good idea to have it if you live in an area with a high rate of uninsured drivers.

Personal Injury Protection

Personal injury protection (PIP) pays for medical bills and lost wages if you’re injured in an accident. This coverage is optional, but it’s a good idea to have it if you don’t have health insurance.

Gap Insurance

Gap insurance pays the difference between the value of your car and the amount you owe on your loan if your car is totaled in an accident. This coverage is optional, but it’s a good idea to have it if you have a loan on your car.

Now that you understand the different types of car insurance coverage, you can make an informed decision when selecting a policy. Be sure to shop around and compare quotes to get the best coverage for your needs.

How to Calculate Your Car Insurance Needs

When it comes to car insurance, it’s important to make sure you have the right coverage for your needs. Knowing how to calculate your car insurance needs can help you make sure you’re getting the best coverage for your situation.

The first step in calculating your car insurance needs is to determine the type of coverage you need. There are several types of coverage available, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Liability coverage is the most basic type of coverage and covers damage you cause to another person’s property or injury to another person. Collision coverage covers damage to your car if you are in an accident. Comprehensive coverage covers damage to your car from non-accident related events, such as theft or vandalism. Uninsured/underinsured motorist coverage covers you if you are in an accident with someone who does not have insurance or does not have enough insurance to cover the damages.

Once you have determined the type of coverage you need, you can start to calculate the amount of coverage you need. The amount of coverage you need will depend on several factors, including the value of your car, the amount of money you can afford to pay out of pocket if you are in an accident, and the amount of risk you are willing to take.

For liability coverage, you should consider the value of your car and the amount of money you can afford to pay out of pocket if you are in an accident. You should also consider the amount of risk you are willing to take. If you are willing to take on more risk, you may be able to get away with a lower amount of coverage.

For collision and comprehensive coverage, you should consider the value of your car and the amount of money you can afford to pay out of pocket if you are in an accident. You should also consider the amount of risk you are willing to take. If you are willing to take on more risk, you may be able to get away with a lower amount of coverage.

Finally, for uninsured/underinsured motorist coverage, you should consider the amount of money you can afford to pay out of pocket if you are in an accident with someone who does not have insurance or does not have enough insurance to cover the damages.

Calculating your car insurance needs can be a complicated process, but it is important to make sure you have the right coverage for your situation. Knowing how to calculate your car insurance needs can help you make sure you’re getting the best coverage for your situation.

Tips for Finding the Best Car Insurance Rates

Finding the best car insurance rates can be a daunting task. With so many different companies offering different coverage options, it can be difficult to know where to start. Here are some tips to help you find the best car insurance rates:

1. Shop Around: Don’t just settle for the first car insurance quote you get. Take the time to compare rates from multiple companies to ensure you’re getting the best deal.

2. Consider Your Coverage Needs: Before you start shopping for car insurance, take the time to consider what type of coverage you need. Do you need comprehensive coverage or just liability? Knowing what type of coverage you need will help you narrow down your search.

3. Ask About Discounts: Many car insurance companies offer discounts for certain drivers. Ask about any discounts you may qualify for, such as good driver discounts, multi-car discounts, or discounts for having a good credit score.

4. Bundle Your Policies: If you have multiple policies with the same company, such as home and auto insurance, you may be able to get a discount by bundling them together.

5. Pay Your Premiums Annually: Paying your premiums annually instead of monthly can help you save money on your car insurance.

By following these tips, you can find the best car insurance rates for your needs. Be sure to compare rates from multiple companies and ask about any discounts you may qualify for.

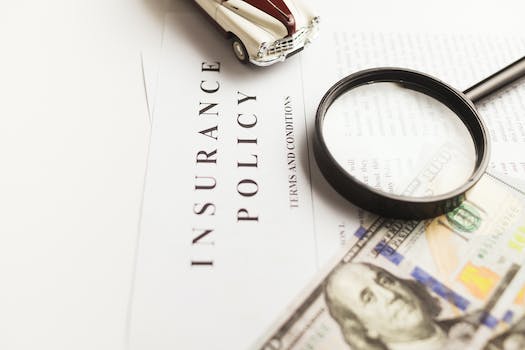

What to Look for When Comparing Car Insurance Policies

When comparing car insurance policies, there are several key factors to consider. Here are some of the most important things to look for when comparing policies:

1. Coverage: Make sure the policy you choose provides the coverage you need. Consider the types of coverage offered, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

2. Deductibles: Deductibles are the amount of money you must pay out-of-pocket before your insurance company will cover the rest of the cost of a claim. Higher deductibles usually mean lower premiums, so consider your budget when choosing a deductible.

3. Discounts: Many insurance companies offer discounts for certain types of drivers, such as good drivers, students, and seniors. Make sure to ask about any discounts you may qualify for.

4. Customer Service: It’s important to choose an insurance company that provides excellent customer service. Read reviews and ask friends and family for their experiences with different companies.

5. Price: Of course, price is an important factor when comparing car insurance policies. Make sure to compare the same coverage levels and deductibles when comparing prices.

By taking the time to compare car insurance policies, you can make sure you get the coverage you need at a price you can afford.

How to Choose the Right Deductible for Your Car Insurance Policy

When it comes to car insurance, choosing the right deductible is an important decision. Your deductible is the amount of money you’ll pay out of pocket before your insurance company pays for any damages or losses. A higher deductible can mean lower premiums, but it also means you’ll be responsible for more of the costs if you have an accident.

Before you decide on a deductible, it’s important to consider your financial situation. If you don’t have enough money saved to cover a high deductible, it’s probably not a good idea to choose one. On the other hand, if you have enough money saved to cover a higher deductible, it could be a good way to save on your premiums.

It’s also important to consider the type of coverage you have. If you have comprehensive coverage, you may want to choose a higher deductible to save on your premiums. However, if you only have liability coverage, you may want to choose a lower deductible to ensure you’re covered in the event of an accident.

Finally, it’s important to consider the value of your car. If you have an older car, you may want to choose a higher deductible to save on your premiums. However, if you have a newer car, you may want to choose a lower deductible to ensure you’re covered in the event of an accident.

Choosing the right deductible for your car insurance policy can be a difficult decision. It’s important to consider your financial situation, the type of coverage you have, and the value of your car before making a decision. By taking the time to research your options, you can ensure you’re getting the best coverage for your needs.

Conclusion

Choosing the right car insurance policy for you can be a daunting task, but it doesn’t have to be. By understanding your needs, researching different policies, and comparing quotes, you can find the policy that best fits your needs and budget. With the right policy in place, you can rest assured that you and your vehicle are protected in the event of an accident.